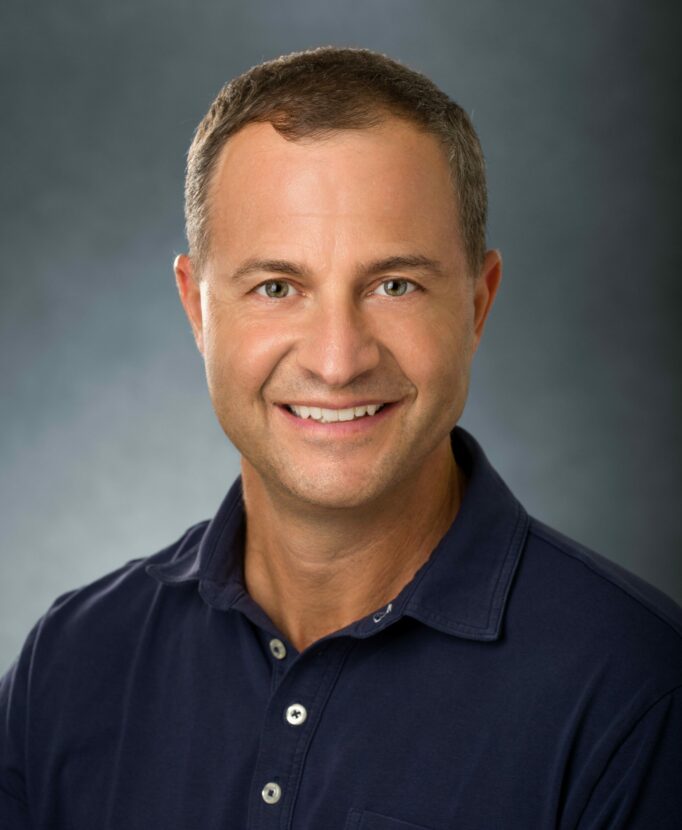

Ted Seides

Keynote Speaker

Ted Seides, CFA is the Founder of Capital Allocators LLC, which he created in 2016 to explore best practices in the asset management industry from the perspective of asset owners, asset managers, and interdisciplinary thought leaders.

CONTACT WSB FOR Ted Seides'S SPEAKING FEES

Ted Seides hosts the Capital Allocators podcast, co-hosts Capital Allocators Summits, advises asset managers and allocators across audio content, investing, and business strategy, and is a columnist for Institutional Investor.

The Capital Allocators podcast has been downloaded 5 million times as of January 2021 and reaches a weekly audience of more than 50,000, including many of the world’s leading institutional investors and asset managers.

In March 2021, Ted published his second book, Capital Allocators: How the world’s elite money managers lead and invest to distill the lessons from the first 150 episodes of the podcast.

Previously, Ted was a founder and served as President and Co-Chief Investment Officer of Protégé Partners, LLC, where he spent 14 years leading the multi-billion-dollar alternative investment firm that invested in and seeded hedge funds.

Ted began his career in 1992 under the tutelage of David Swensen at the Yale University Investments Office. He spent a summer job and two years after business school investing directly at three of Yale’s managers.

Along the way, Ted was featured in Top Hedge Fund Investors: Stories, Strategies, and Advice, authored So You Want to Start a Hedge Fund: Lessons for Managers and Allocators, and made a ten-year charitable bet with Warren Buffett pitting hedge funds against the S&P 500. You can hear Ted’s story in his own words on Capital Allocators Episodes 45 (It’s Not About the Money), 34 (Deep Dive on Hedge Funds), and 5 (The Bet with Buffett).

Ted holds a BA, Cum Laude, from Yale University and an MBA from Harvard Business School.

Ted Seides’s Speech Topics

-

Five Non-Investment Tools Every Investment Manager Needs to Succeed

Ted draws on his 25 years of experience picking winning money managers and more than 2,000 manager interviews to distill the five most critical non-investment tools investment managers need to succeed in the money game.

-

The Art and Science of Manager Selection

How do you find a good manager? After you find them, how do you make sure the returns keep coming? Ted walks through the 5 stages in the art and science of manager selection: sourcing, diligence, decision-making, monitoring, and exiting.

-

Top of the Funnel Interest for Allocators: ESG, DE&I, Private Equity, and Crypto

Ted takes audiences on a whirlwind tour of the hot topics on the minds of institutional allocators today, including ESG, DE&I, Private Equity, and Crypto.

-

Perspectives on Hedge Funds After the Buffet Bet

In 2008, Warren Buffet challenged the Hedge Fund industry to a 10-year long bet. The challenge: the S&P 500 versus any Hedge Fund for total returns net of fees over a 10 year period. The stakes: $1m to the charity of the winners choice. Ted Seides took Buffet up on his challenge, and 10 years later, a small girls educational charity in Omaha received a gift that doubled its annual revenue. Ted shares with audiences the story behind the famous bet and his perspective on hedge funds since.

-

What’s on Ted’s Mind

Ted addresses the current events and issues in finance: SPACs, short-selling, tail-risk events, ESG etc.

-

Lessons from the Master – What I Learned from David Swensen and What I Tried to Forget

Ted began his career at the Yale Endowment, working for and learning from famed investor and innovator of the “Endowment Model”, David Swensen. In this talk, Ted shares what he learned from David, and how he applied that knowledge when starting his own hedge fund.

-

Getting the G in ESG Right

Ted distills lessons in good governance from 25 years in the capital allocation business and more than 2,000 interviews with money managers, executives, and thought leaders.

Works by Ted Seides

REQUEST AVAILABILITY

Tell us about your event and the speaker you are interested in booking and we will be in touch right away.